Tanker Market Subdued During July

16.08.2021

The tanker market remained in subpar level during the month of July. According to the latest monthly report from OPEC, events in July provided little momentum to the languishing tanker market, with dirty freight rates remaining at subdued levels. As soon as positive signs appear on the horizon, offsetting darker clouds seem to emerge as well. Demand for tankers is expected to pick up in 2H21, easing the imbalance versus tonnage availability, further helped by increased scrapping and low new deliveries. However, the rapid spread of the Delta variant has provided some uncertainty to the outlook, potentially pushing off the tanker market recovery into 2022.

Spot fixtures

Global spot fixtures declined m-o-m in July, falling by 1.7 mb/d, or around 11%, to average 13.8 mb/d. Declines came as Asian and European buying remained muted. Compared to the previous year, spot fixtures were slightly lower, falling by less than 1%. It should be noted that rates began the current low phase already in June 2020, coming down sharply from the exceptionally high levels seen earlier in 2Q21.

OPEC spot fixtures rose m-o-m in July, increasing by 0.5 mb/d, or almost 6%, to average just under 10 mb/d, amid a scheduled easing of production adjustments. Compared with the same month last year, OPEC spot fixtures were about 14% higher, rising by just under 1.0 mb/d. Fixtures from the Middle East-to-East averaged 5.9 mb/d in July, representing a gain of 0.5 mb/d, or 6% m-o-m, amid increased flows from the region to the Far East. Y-o-y, the route saw an increase of 0.7 mb/d, or over 14%. Middle East-to-West fixtures declined by almost 19%, or around 0.2 mb/d m-o-m, to average 870 tb/d, amid lower flows to Northwest Europe (NWE) and the Mediterranean. This was around 0.2 mb/d, or almost 32%, higher than in the same month last year. Outside the Middle East fixtures edged up 30 tb/d, or 1% m-o-m, to average 3.2 mb/d. Y-o-y, fixtures were around 6%, or around 0.2 mb/d higher.

Sailings and arrivals

OPEC sailings continued to rise m-o-m in July, gaining 0.7 mb/d, or over 3%, to average around 22.2 mb/d. Y-o-y, OPEC sailings were 2.1 mb/d, or 11%, higher than the very low levels seen in July 2020. Middle East sailings continued to show m-o-m gains in July, edging up by 0.3 mb/d, or close to 2%, to average 15.6 mb/d. Y-o-y, sailings from the region rose 1.8 mb/d, or 13%, compared with the same month last year. Crude arrivals in July were higher m-o-m on all routes with the exception of Europe. Arrivals in North America averaged 9.0 mb/d, representing a gain of 0.1 mb/d m-o-m, or around 2%, and a 1.2 mb/d, or over 15% increase y-o-y. Arrivals in the Far East averaged 15.0 mb/d in July, an increase of 1.6 mb/d, or 12% m-o-m, and a massive 5.8 mb/d, or over 63%, higher than the same month last year. In West Asia, arrivals more than recovered from the previous month’s losses, rising by 0.8 mb/d, or over 13%, to average 6.9 mb/d. Y-o-y, West Asia arrivals were 2.3 mb/d, or just over 50%, higher. European arrivals were relatively stable in July at 12.8 mb/d, marginally lower than in the previous month and a massive 3.9 mb/d, or 44%, higher than the same period last year.

Dirty tanker freight rates

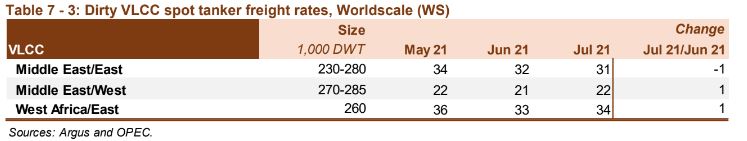

Very large crude carriers (VLCCs)

VLCC spot rates edged higher m-o-m in July, rising by 4%. However, VLCC rates declined 17% compared with the same month last year when rates were still coming down from very high levels. Rates on the Middle East-to-East route dropped by 3% m-o-m to average WS31 points as flows to Singapore declined. Y-o-y, rates were 21% lower. In contrast, rates on the Middle East-to-West route rose m-o-m by 5% in July to stand at WS22 points as gains in France and Italy offset declines in the Netherlands. However, y-o-y, rates were 12% lower. The West Africa-to-East route also increased by 3% m-o-m in July to average WS34 as insufficient import quotas constricted buying by Chinese independents. However, rates were 21% lower compared with July 2020.

Suezmax

Suezmax rates were down by 2% m-o-m in July amid lower demand for flows to the Far East as well as Europe. Rates were 7% lower compared to the same month last year. On the West Africa-to-USGC route, rates averaged WS46, a gain of 2% compared to the month before. Y-o-y, rates were 7% higher than in July 2020. Meanwhile, spot freight rates on the USGC-to-Europe route declined 5% m-o-m to average WS37 points. This was 20% lower compared with the same month last year.

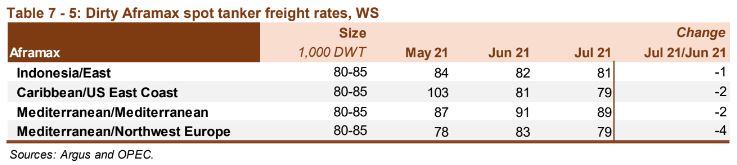

Aframax

Aframax rates fell further in July, dropping by 2% m-o-m as tonnage demand for the class in the Far East and Europe eroded. Minor declines were seen on all monitored routes. Y-o-y, rates were 28% higher. The Indonesia-to-East route saw a 1% decline m-o-m to average WS81, but was still 25% higher y-o-y. The Caribbean-to-USEC route fell 2% m-o-m to average WS79 in July, while rates were 11% higher y-o-y.

Med routes also fell m-o-m in July. The Cross-Med route averaged WS89 in July, representing a drop of 2% compared with the previous month. Y-o-y, however, rates were 41% higher. On the Mediterranean-to-NWE route, rates fell by 5% m-o-m in July to average WS79. Compared with the same month last year, rates on the route were 39% higher.

Source : Hellenic Shipping News