ICS Maritime Barometer Report: Protectionism highlighted as a risk for shipping’s decision makers

11.09.2024

Data from the ICS Barometer Report 2023-2024, launched today, has demonstrated the positive impact that improved clarity from governmental bodies such as the International Maritime Organization (IMO) have had on the sector.

The comprehensive survey of over 100 global maritime industry leaders over a three-year period analyses year-on-year shifts in sentiment on pivotal issues influencing operations. It has tracked steadily rising confidence among maritime leaders in their ability to cope with challenging operating conditions.

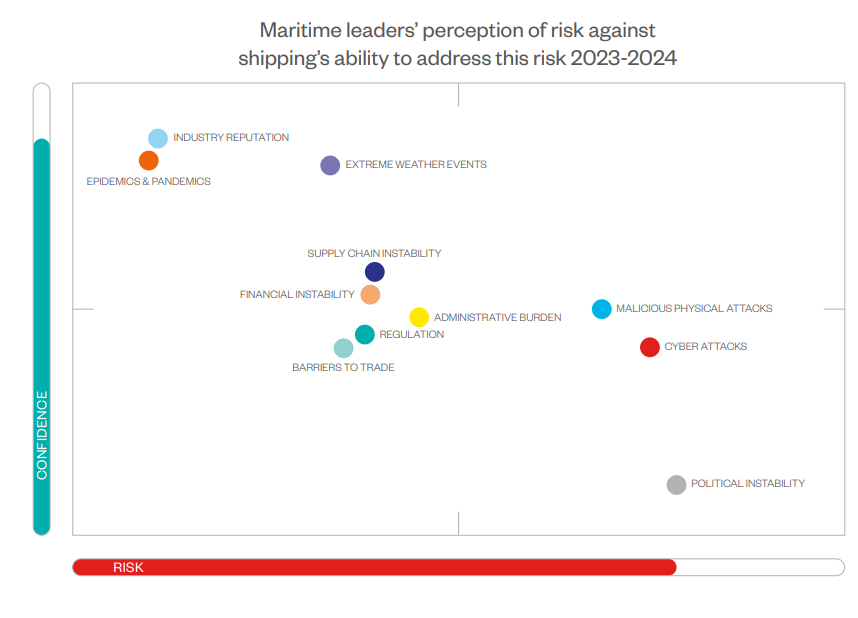

Areas of concern for respondents include the recent increase in geopolitical instability (which is seen as a risk multiplier as it impacts other factors), malicious physical attacks and cyber-attacks (by state and non-state actors), as well as updates to global and/or regional regulatory environments and availability of fuels and infrastructure driving decarbonisation.

This report tracks our industry’s progress through recent gains in confidence, while also noting key pressure points — such as the availability of public funding for green initiatives and the impact of market-based measures — which continue to require greater collaborative effort across industry leaders, government bodies, and international partners to address.

…Emanuele Grimaldi, Chairman of the International Chamber of Shipping, comments.

Over the past year, the maritime industry has proven its ability to maintain trade despite pandemic-related challenges, and maritime leaders’ risk concerns have

shifted to financial and political instability, reflecting wider societal trends. This section delves into existing risks and leaders’ confidence to address these issues.

Political instability is a risk multiplier, threatening economic volatility and reduced growth as longstanding policies, trade arrangements and relationships are eroded.

The results can have major consequences for trade and transport. Heightened risk perception and lower confidence around political instability reflected rising unease across many regions. The impact of the conflict in Ukraine on food and energy prices was dramatic and remains a factor despite multilateral efforts to restore trade. Simmering territorial disputes in the South China Sea and ongoing instability in South Asia grew more entrenched, threatening trade in each region. Political instability affects many aspects of maritime business including trade flows, port access and supply of seafarers. By driving waterborne migration in unsafe vessels or increasing stowaway attempts, humanitarian crises also have a direct impact on maritime safety.

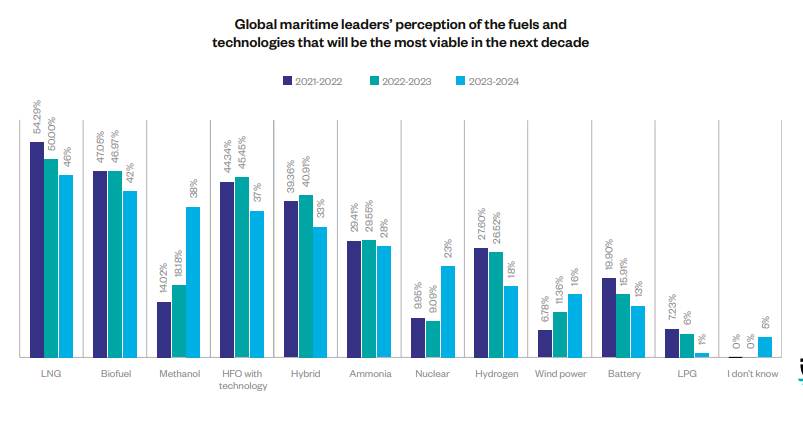

Fuels and Technologies

Fuel remains an integral part of shipping’s decarbonisation equation and while the broad expectation is for a multi-fuel future, the industry perception of individual technologies has changed significantly over the past two years. The continued strength of LNG, biofuel, and HFO with abatement technology in leaders’ forecasts for the next decade demonstrate the power of the familiar in an uncertain time for the shipping industry, although each is seen as less viable than it was in 2022-23.

Investments in alternative fuels require significant capital expenditure on ships and even larger investments on land, both in fuel production and infrastructure for distribution; each of the familiar fuels limit investment risk in some capacity. Writing in their Review of Maritime Transport 2023, UNCTAD stated that decarbonising the world’s fleet by 2050 could require an estimated USD 8 billion to USD 28 billion annually.

The infrastructure for 100% carbon-neutral fuels could need an even heftier USD 28 billion to USD 90 billion each year. With elections in 64 countries plus European Union elections this year, the tension between the need to decarbonise and the effect of rapid industrial change on workers and voters is a challenge to investors in large scale green fuel projects looking for clear demand signals from politicians and the public alike.

According to the report, the coming year (2024-2025) will see many countries around the world run by newly formed governments that will be tasked with nurturing industry on their shores and in their territorial waters. There is an urgency to the maritime sector’s calls for clarity and support, which must be translated into action by these powers that frame policy, dictate finance and set the parameters of vessel safety.

Incidents such as a major cyber-attack, another outbreak of war or the announcement of a significant new funding programme are likely to ripple across maritime leaders’ operating landscape and change the balance of sentiments expressed to date.

https://safety4sea.com/wp-content/uploads/2024/09/ICS-Barometer-2023-2024-Full-report_2024_09.pdf

Source:safety4sea