Dry Bulk Market Still Fragile Despite Recent Rally

16.04.2021

Despite the dry bulk market’s recent upward momentum, things are still quite fragile and nothing should be taken for granted. In its latest weekly report, shipbroker Allied Shipbroking said that “with Q1 of the year already passed, it is interesting to note that a typically sluggish period in the year for the dry bulk sector has come to be one of the most promising rallies not seen for many years. The current market has created a lot of enthusiasm in terms of what to expect next, so it may sound odd under such conditions to be talking about risk management, hedging strategies and “defensive” assets”.

“However, thinking about how quickly even fundamental macroeconomic trends can shift, we should not take this rising market as a given. In previous articles, we have pointed out that market sentiment can support relatively good returns for a prolonged period, even if fundamental drivers don’t move accordingly. This may well be a logical assumption to hold. However, how far from reality is the possibility of stumbling back to the average levels noted over the past 2 years? In other words, the current momentum, albeit very bullish, is still fragile”.

According to Allied’s Research Analyst, Thomas Chasapis, “for those who seek diversification, a changing market adds many challenges, especially when given the complexities noted within the shipping industry. A “popular” view of a well-diversified fleet is to maintain an adequate distribution across different size segments within a sector. On an initial look it seems to be a ‘well-intended’ strategy. Different sizes may well mean less overall volatility (or more “symmetrically distributed volatility” through time), different trade regions (diversification in geopolitical risks), different cargoes (diversification in commodity market exposure) etc. This may well be correct, yet this approach does not cover enough risks that would ultimately be reflected from opposing movements in earnings. What usually happens is that you have short time lags in reactions between the different size segments. An opportunity “window” to respond according to the appealing return/risk profile. One could frame it as a time varying (or dynamic) hedging tactic”.

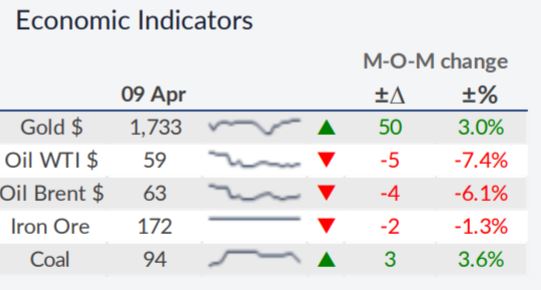

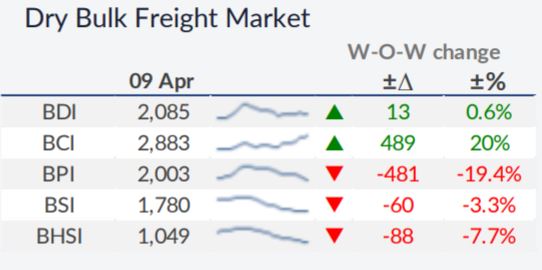

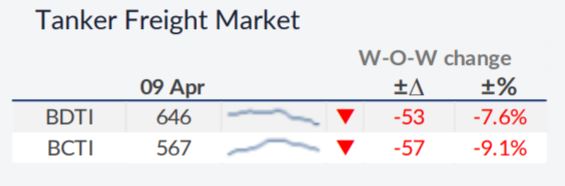

Chasapis added that “a much stronger strategy has always been a much broader approach to a diversified “portfolio” encompassing a distributed fleet across different shipping sectors. As one can see when taking as an indicator the 1 year rolling correlation coefficient between the BDI and BDTI indices, their relationship the majority of the time seems uncorrelated (fluctuating between 0.5 and -0.5), making them ideal candidates for someone seeking to diversify their portfolio and minimize their risks.

However, over the past 6 months or so these two markets seem to be moving over to a strong negative correlation (with the past 3 months showing significant negative relationship of close to -0.8) making them more ideal candidates for hedging strategies. All-in-all, many concepts and business strategies do not respond similarly in all market conditions. A dynamic approach is essential to catch up with the changing dynamics and market environment. Overall, the shipping industry has shown that it is prone to underprice risk factors during periods of a full market cycle. The perilous path now is that it can be common amongst investors to take general long-term market relationships as a given rather than noticing the changing trends and be left greatly exposed to a risk that has not even been factored in”, Allied’s analyst concluded.

Source:Hellenic Shipping News